Solar Finance

Why Solar for Your Home or Business

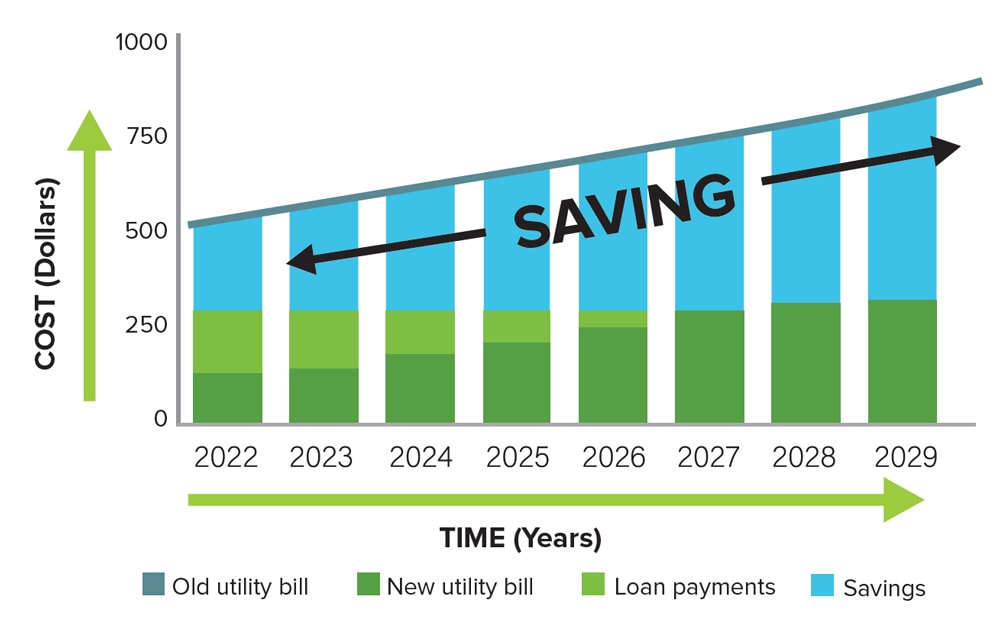

Lower Energy Bills

With a solar panel system, you’ll generate free daytime power for your system’s entire 25+ year lifecycle.

Future Proof

In the past ten years, residential electricity prices across Australia have just about doubled.

Source Clean Energy Council. Consumer increase 2006 to 2016: WA 85%;

Solar Incentives

STCs are part of the Government’s Renewable Energy Target scheme to incentivise installation of renewable energy systems.

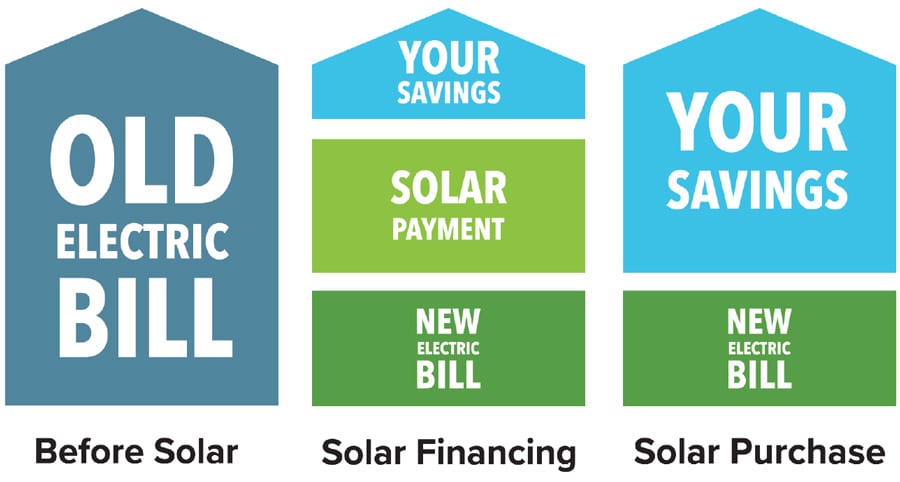

Day 1 Cash Flow

You can finance a system affordably without any up front costs and begin generating cash-flow positive returns from your very next energy bill.

Reduce Carbon Footprint

A typical residential solar panel system will eliminate three to four tons of carbon emissions each year – the equivalent of planting over 100 trees in a year.

Property Value

Multiple studies have found that homes equipped with solar energy systems have higher property values, will rent for more and sell more quickly than non-solar homes.

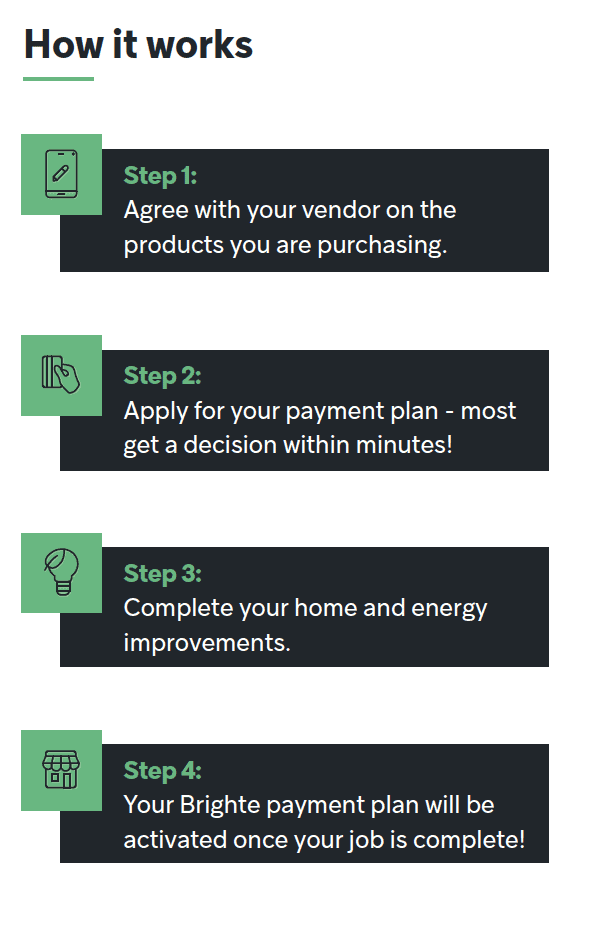

Finance your energy solution today!

Finance your energy solution today!

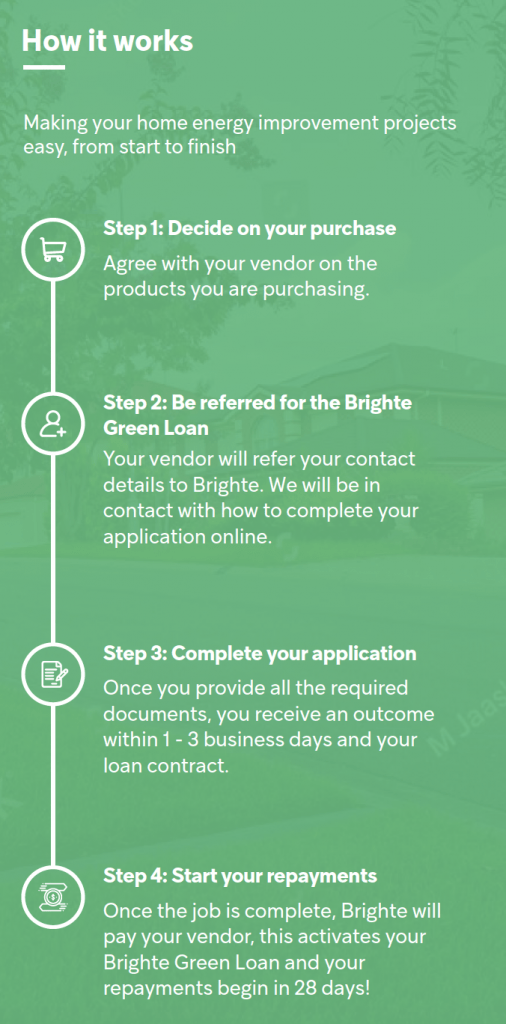

Perth Solar Force has teamed up with Brighte to offer you two great residential finance deals.

Make the choice to create a sustainable, energy-efficient home today!

0% Interest Payment Plan:

- 0% Interest

- $1 Weekly Account Keeping Fee

- Eligibility Criteria

Approved applicants only.

Minimum finance amount $1,000.

A late payment fee of $4.99 may be charged if you miss a repayment. Late fees are capped at $49.90 per calendar year.

Credit provided by Brighte Capital Pty Limited ABN 74 609 165 906.

To Be Eligible for the 0% Interest Payment Plan:

You Must Meet This Criteria

Be over 18 years old

Be an Australian resident or citizen

Own or be purchasing your own home

Have a clear credit file

Employed for more than 25 hours per week, a self-funded retiree; or receiving the Government Aged Pension/Veteran's Pension

* Credit provided by Brighte Capital Pty Ltd (ABN 74 609 165 906). Approved applicants only. Min finance amount $1,000. Late payment fee of $4.99 may be charged if you miss a repayment.

Brighte Green Loan:

- 7.99% p.a. interest rate** | Comparison rate 8.71% p.a.^

- $299 establishment fee incorporated into the loan amount

- $1 Weekly Account Keeping Fee

- Eligibility Criteria

Credit provided by Brighte Capital Pty Ltd (ABN 74 609 165 906).

Australian Credit License Number 508217.

All applications are subject to Brighte’s credit approval criteria. Fees, terms and conditions apply.

To Be Eligible for Brighte Green Loan:

You Must Meet This Criteria

Be over 18 years old

Be an Australian resident or citizen

Own or be purchasing your own home

Provide two most recent payslips or 90 days of bank statements

Employed for more than 25 hours per week, a self-funded retiree; or receiving the Government Aged Pension/Veteran's Pension

** Information and interest rates are current as at 8 June 2020 and are subject to change. Late payment fee of $4.99 may be charged by Brighte if you miss a repayment. All applications for credit are subject to Brighte’s credit approval. Fees, terms and conditions apply.

^ Comparison rate calculated on an unsecured loan amount of $30,000 over a term of 5 years based on fortnightly repayments

WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.